Context:

XRP is a crypto created by Ripple and presents itself as a method of paying cross guarantee. It is currently the fourth largest cryptocurrency in terms of market capitalization.

Recent data emphasizes the three main reasons by which the XRP has the potential to achieve this goal soon: the FDV XRP, which has crossed the reasons for ETH, will move capital from ETH to XRP and the investor’s feeling is increasingly positive about Krypto Ripple.

The fully diluted XRP award exceeded the ETH award

According to the latest CoinMarketcap XRP data, Ethereum has officially exceeded the fully diluted award (FDV). More precisely, XRP FDV is currently $ 210 billion, while ETH is $ 196 billion.

FDV is a key indicator that reflects the potential value of all tokens in the total offer, including those that are not yet in circulation. This suggests that XRP has a greater award than ETH when you consider their maximum offer.

Investors like John Squire and Edoardo Farina see the superiority of XRP in terms of FDV as a precursor that its market capitalization could soon exceed Ethereum.

“This means more than 6 consecutive months during which XRP has exceeded Ethereum. Defense has already begun!” Edoardo Farina predicted.

Investor Donnie also thinks that the highest FDV XRP signals a change in market perception. According to him, it reflects the growing acceptance of the ripple of crypto investors. This feeling seems to support stories and predictions around XRP compared to ETH stories.

Capital moves from Ethereum to XRP

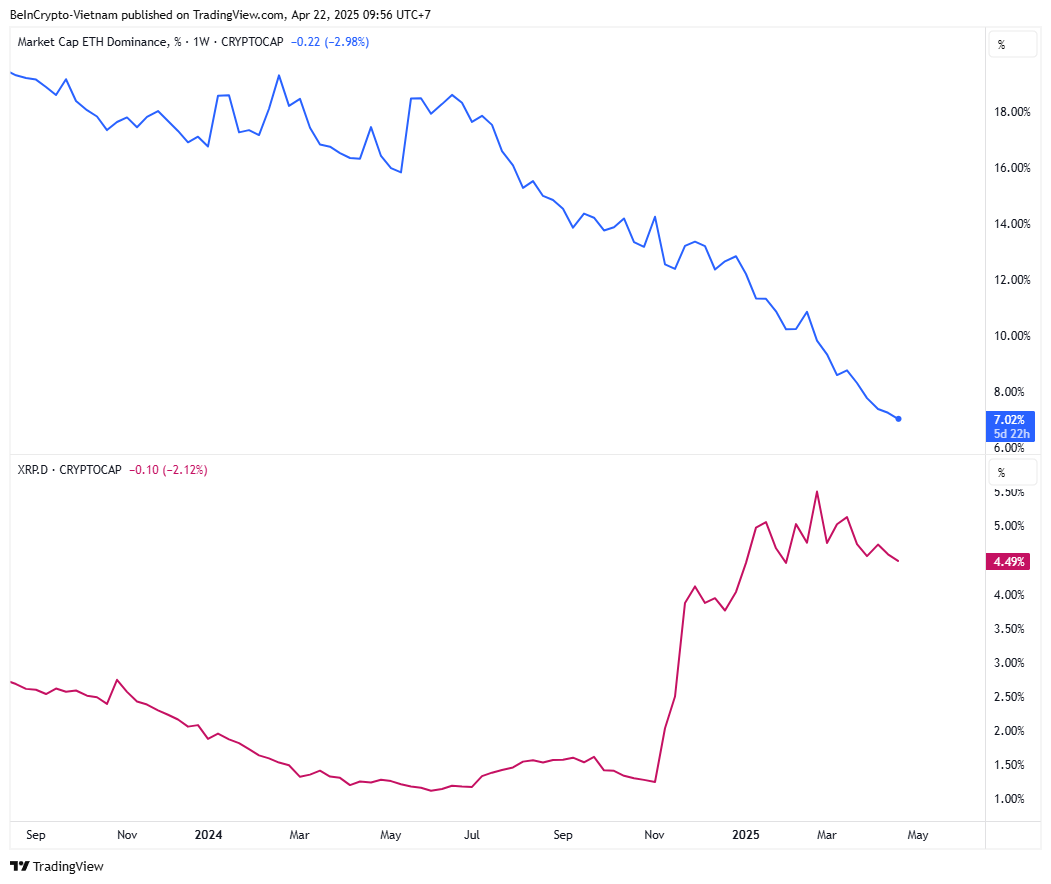

Another key factor is the movement of investment capital between the two cryptocurrencies. Data Tradingview shows that dominance ETH (ETH.D) dropped to a new cavity, while the dominance of XRP (xrp.d) in 2025 increased sharply.

Dominance indices reflect the distribution of capital on the market. Since November last year, ETH.D increased from 14 % to 7 %. XRP.D increased from 1.2 % to 4.5 %. This contrast clearly shows that investors prefer XRP compared to ETH.

This capital movement also caused a remarkable technical result. The XRP/ETH graph has actually exceeded the trend line down, which has been introduced since 2016, which signals a long -term ascending trend for a pair.

This rupture represents more than a simple technical signal. It also reflects more important movements in the market feeling: investors are increasingly focusing on XRP.

A recent news of Coinshares supports this idea. It indicates that investment products in digital active ingredients recorded contrast flows between ETH and XRP last week. So, while Ethereum recorded $ 26.7 million trips, XRP attracted a strong tide of $ 37.7 million.

This displacement of capital shows the growing potential of XRP to fill the difference with the Ethereum market.

The feeling of investors is more positive to the XRP

Finally, the feeling of investors leans in favor of XRP. Recent reports emphasize growing optimism around XRP, while Ethereum faces greater skepticism.

According to the recent Beincrypto report, the price of XRP seems to be in the “predetermined” growth phase. This idea is supported by the support of financial institutions and the XRP development potential.

Recent reports also supported the positive atmosphere for XRP holders. Ripple won a hidden road within an agreement of $ 1.25 billion. Hashkey founded the first institutional investment fund in XRP in Asia. Finally, Coinbase also introduced term contracts on XRP regulated CFTC.

On the other hand, ETH continues to solve negative titles and doubts. Reports such as “dominance Ethereum are the lowest level in 5 years” and criticism of ETH as “pre -committed centralized games” significantly deteriorated the perception of the public.

The market feeling is the main engine of price movements of cryptocurrencies. Increasing XRP support could move it outside ETH in market capitalization.

Morality of History: A crypto that does not grow up will lose its place.

Notification of irresponsibility

Notice of non -response: In accordance with the Trust project Directives, this article for price analysis is intended only for information purposes and must not be considered financial or investment advice. Beincrypto undertakes to provide accurate and impartial information, but market conditions may change without prior notice. Always carry out your own research before making any financial decision and consult a professional.