In the new report, however, the cryptocurrency analyst suggested that this autumn bitcoin could only be a preparation for a new ascending move.

Bitcoin Relapse, Opportunity by Wise Investors

In the report by a cryptocurrency analyst known by the banker pseudonym, he identified three key signals that indicate that Bitcoin could experience a jump in his short course. In particular, the room indicator is one of these signals.

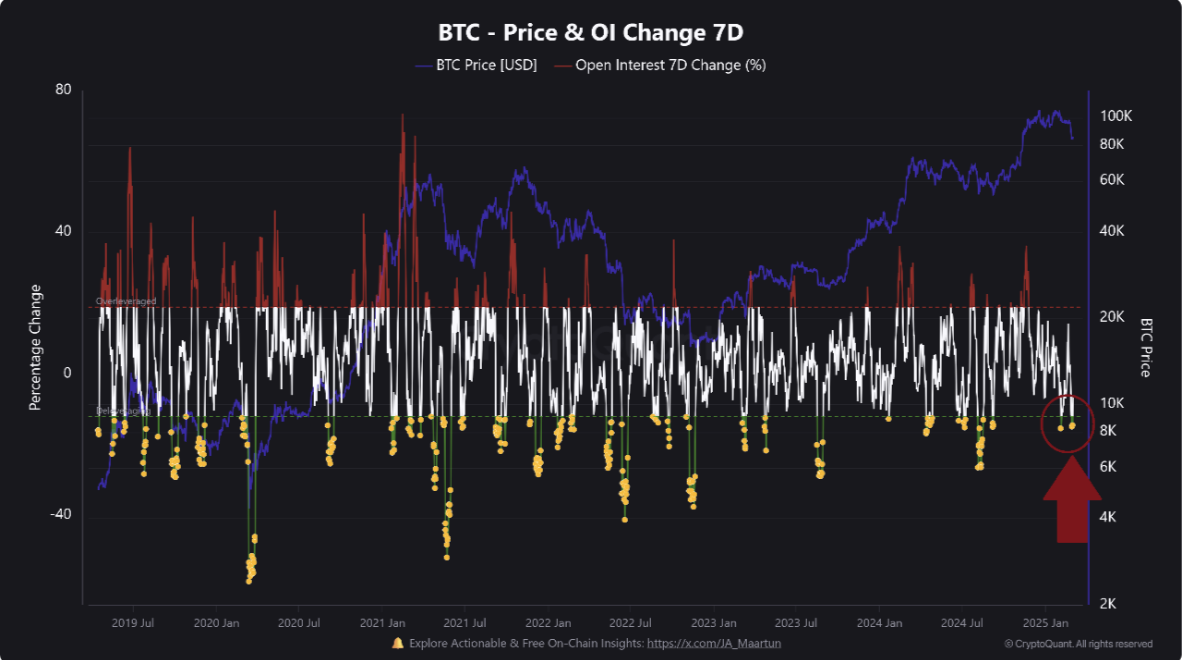

According to a banker, the change of open interest of bitcoins (7D) “decreased significantly and 1 March decreased by -14.42 %. »»

We remind you that open interest measures the total number of derivative contracts during the asset, such as future (or term contracts) and options that have not been set. The decrease in the open interest of BTC suggests that the effect of the lever on the market is declining. In the past, similar decreases in this indicator often represented the buyer the opportunity to enter the market at lower levels, which could potentially feed a new ascending movement.

“Such brutal reduction often points to a reduction in speculative activity and may be a high opportunity to buy during cavities on the market, as this may indicate surparation or resetting positions,” the banker wrote.

Another signal that points to the reflective potential is the decline in the index of fear and greed of crypto maché or index fear and greed. At the time of writing this article, this index is currently 15, suggesting extreme fear between market participants. This suggests that investors are very careful, which encourages them to increase sales activity.

According to historical data, the levels of extreme fear suggest that the market is and the floor is approaching. This often represents the opportunity to buy for traders who try to “buy low and sell high”. »»

“A recent decline suggests a cooling period that could open the way to a healthier market environment,” wrote a banker.

So if BTC traders use this trend and increase their accumulation of parts, it could prepare the soil for a short -term reflection. In addition, expectations around the crypto summit of March 7 in the White House could “serve as a catalyst for short -term market movements,” Banks said.

This summit was organized by David Sacks, “Car” AI and the White House Krypto and President Donald Trump, aiming to shape US crypto regulations. This means a fundamental change in the policy of digital assets in the United States, which will be emphasized by the government pro-cypto approach and its commitment to better regulatory clarity.

According to a banker:

“Depending on the results and announcements, a small bull could occur. Investors should remain cautious, but vigilant, because the current decline in open interest and feeling could offer strategic entry points for those who have a longer period of time. »»

Bitcoin course is close to the critical level of RSI

In addition to these macro and macro indicators, RSI BTC, practically on the territory of daily graphics, confirms the ascending prospect of a banker. At the time of writing this article, this momentum of momentum, which measures the conditions of the occurrence and excessive handover of the asset, 36.88.

The RSI value suggests that BTC approaches the level of occurrence and could therefore experience a positive short -term correction. If confirmed, part could monitor and start the assembly to resist at $ 92,247.

Conversely, if the trend persists, the BTC rate could slip towards $ 80.

Morality History: Bitcoin Relapse for Better Purchase.

Notification of irresponsibility

Notice of irresponsibility: In accordance with the Trust project Directives, this article for price analysis is intended only for information purposes and must not be considered financial or investment advice. Beincrypto undertakes to provide accurate and impartial information, but market conditions may change without prior notice. Always carry out your own research before making any financial decision and consult a professional.