Context:

Kraken is one of the most important platforms for the exchange of cryptocurrency, while BNB is the flag token of the ecosystem connected to the competitive binance platform.

This initiative Kraken especially attracted the attention of the crypt community. It is also perceived as a strategic point of turnover, which could potentially prepare the way for a wave of BNB statements on other American platforms such as Coinbase, Gemini and other exchanges.

American legal environment that has long been avoided by BNB

Cryptos platforms have long been postponed by Token BNB due to legal concern about binance, its parent company. In 2023, the United States Commission filed a complaint against binance with the question of unregistered titles, including BNB.

In the face of this legal supervision, many platforms hesitated that the token because of potential regulatory risks.

However, the turnover took place at the end of 2024, when Binance concluded an agreement with the US authorities. The platform has actually agreed to pay a fine of $ 4.3 billion and introduce stricter reforms of compliance. This resolution thus generally increased the “legal obstacle” for BNB, which potentially influenced Kraken’s decision to give this speech.

Regulatory clarity stimulates altcoins

BNB extract from Kraken does not have to be an isolated event and reflects a more general change in the regulatory environment for cryptocurrencies in the United States. In January 2024 SEC approved several ETF bitcoins in cash; It was the main progress that was considered a “historical moment” that legitimized bitcoins and other digital assets in the eyes of institutional investors.

While the regulators therefore create lighter managers for digital assets, the US market is gradually opening up altcoins, including BNB.

With the positive development under President Donald Trump, after his inauguration, it could be in time for other platforms to reconsider their position on BNB.

BNB string and its potential in terms of defi

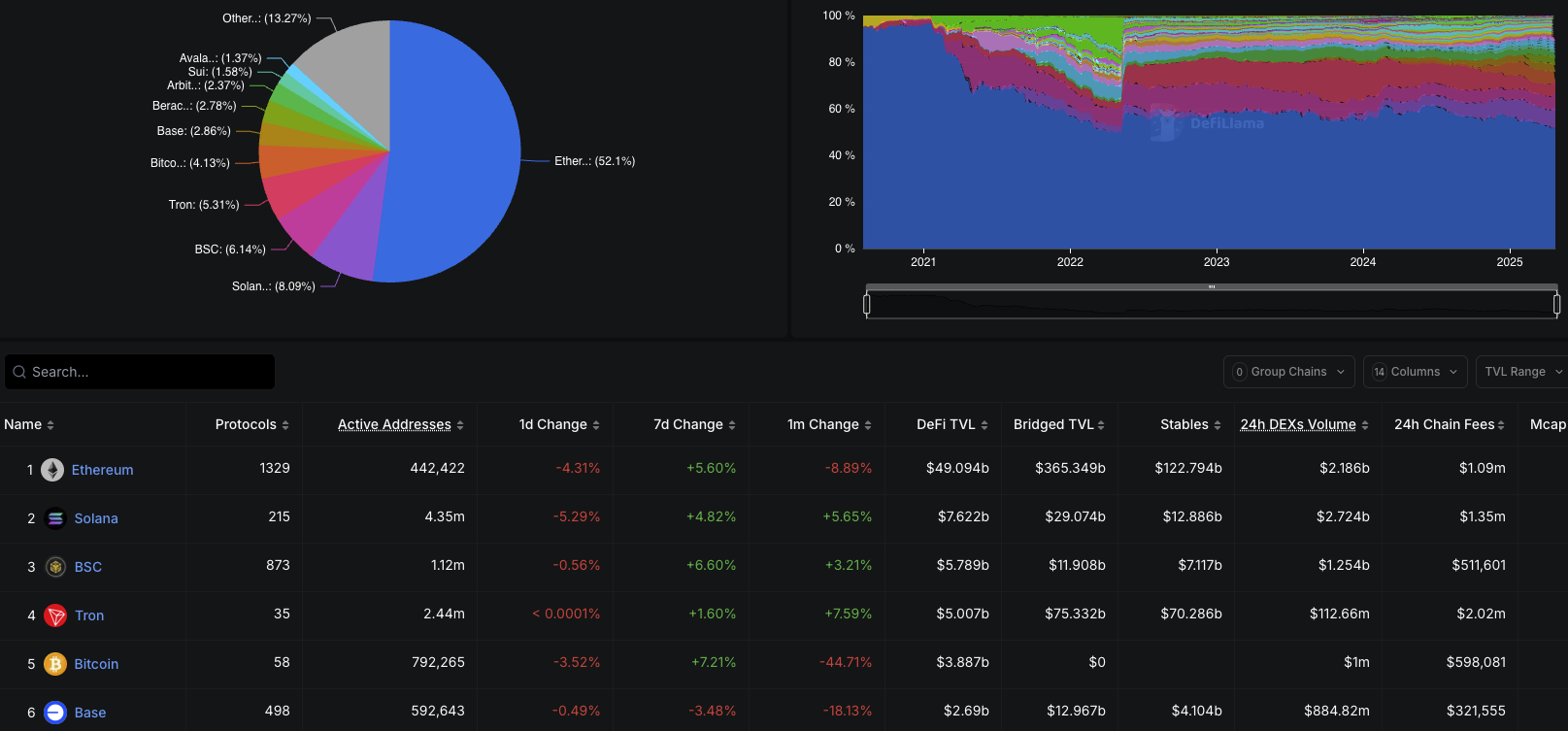

In addition to being a native token, BNB feeds one of the fastest blockchain ecosystems in the industry: BNB chains. According to the BNB ecosystem report, the network recorded more than 3.3 million daily active users during the first week of April 2025.

The total value of the transaction also exceeded $ 7.1 billion. Important Defi, Gamefi and AI are doing well on this platform.

In addition, BNB Chain has introduced considerable technical progress in its 2025 plan. Her team plans to shorten the treatment time for less than a second, allowing transactions without gas cost and intelligence (AI) to decentralized applications (DAPP). These factors make BNB a strategic benefit for platforms and attract Defi users.

The decision of Kraken to list the BNB list could trigger a domino effect in industry. This suggests that US platforms could begin to recognize BNB as a legitimate asset with high potential. This also reflects a change in the strategy of American platforms and moves from a defensive position in the face of legal risks to a proactive approach to using the web3 ecosystem potential.

Morality of History: BNB extract is a crypto rainbow.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.