Context:

After a record summit (ATH) for more than $ 109,000 in January 2025, the Bitcoins (BTC) course went several collars than stabilized between $ 80,000 and $ 85,000. For several days, however, has launched a new increase to exceed the large bar by $ 90,000.

For the supported bitcoin rally, capital must regularly enter the market because it provides liquidity necessary to further increase the course.

Bitcoin gatherings endangered by the Stablecoin indicator in

The prospects of the Bitcoin course were 23 April this Wednesday during the first hours of the Asian meeting. In fact, ascending technical training, especially the descending model of chamfering, has actually designed a new increase for the pioneer crypt.

At the time of writing this article, Bitcoin was replaced for $ 93,714, with the possibility of gathering 9 % to 20 %. The aim of the descending chamfered model is to increase by 20 %, which is determined by the measurement of the largest height of chamfer and overlapping at the end point.

This bull turn is already in progress, while the BTC has transformed the critical resistance into $ 85,000 into support and transformed the support area into a bull reverse point.

Based on the above -mentioned daily graphics for BTC/USDT Trading Pair by daily candles over $ 91,575 could set the tone for long -term bitcoin rally.

Increased purchasing pressure above the immediate resistance of $ 94,000 could lead BTC to target $ 100,000. The crypto could then be expanded to a target of $ 102 $ 239 in a very bull scenario.

Technical indicators are in line with this perspective. The relative force index (RSI) grows and records higher peaks, indicating growing dynamics. Its position below 70 suggests that there is still a margin to increase before BTC passes and represents the risk of correction.

Similarly, the histograms of the oscillator are amazing (AO) in green, which indicates the bull control. Their position above the middle line (in a positive area) thus strengthens ascending work.

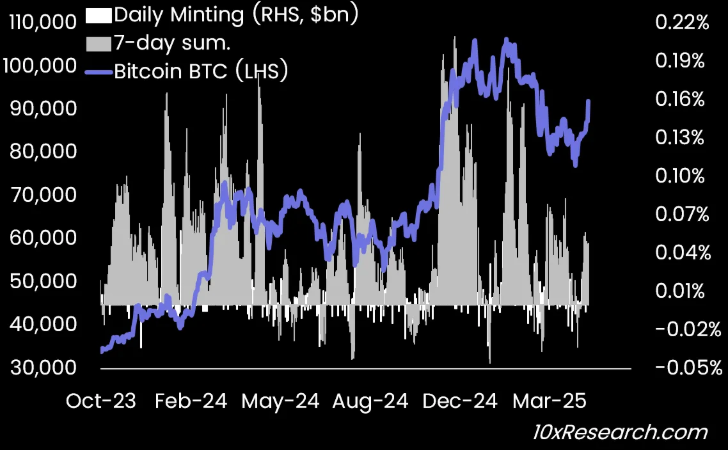

Despite all these encouraging signals, however, Markus Thielen, research manager of 10x research, requires caution and quotes the delay of Stablecoins.

“Given that our stablecoin creation indicator has not yet returned to a high level of activity, we remain careful about the sustainability of the current bitcoin rally,” Thielen wrote in his latest research published 10x.

Stablecoin creation indicator refers to emission or create new stablecoins such as Teth (USDT) or USD coins (USDC). Creating stablecoins often signals capital input to the crypto market, which can have several consequences for the bitcoins course.

Among them is increased liquidity and trust in the market, investors expect profitable opportunities. These two elements represent signs of potential ascending pressure.

According to the analyst of the absence of strong streams of stablecoins, “raises questions about monitoring -UP”. Bitcoin gatherings at a psychological level of $ 100,000 would remain endangered.

It is interesting to note that stablecoins are less significant as the main indicator for the bitcoin course. Analysts report other factors such as institutional flows through the ETF (stock exchange) or strategy purchases (MSTR).

However, if the profits begin, the profit under the center of the Haussier Reverse Point or Bully Switch can reverse the trend. This could immerse bitcoins in the consolidation phase below the key level of $ 85,000.

Morality History: No liquidity, no gatherings.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.