Context:

Crypto whales or crypto whales in English are holders of a very large number of one or more cryptocurrencies. Due to their important parts, their different movements may have a significant impact on the assets of the asset market.

Since September 2023, ETH Crypto Whales brought their assets to the highest level, while OM holders discreetly increased their exhibition on the growing theme of the active world (RWA). On the other hand, XCN experienced a sharp increase in whale activity, accompanied by an increase of 50 % of its price for just 24 hours.

Ethereum (ETH)

The whole crypto market was reflected after Donald Trump announced a 90 -day prize break – except China – with a sense of investors with regard to risky assets.

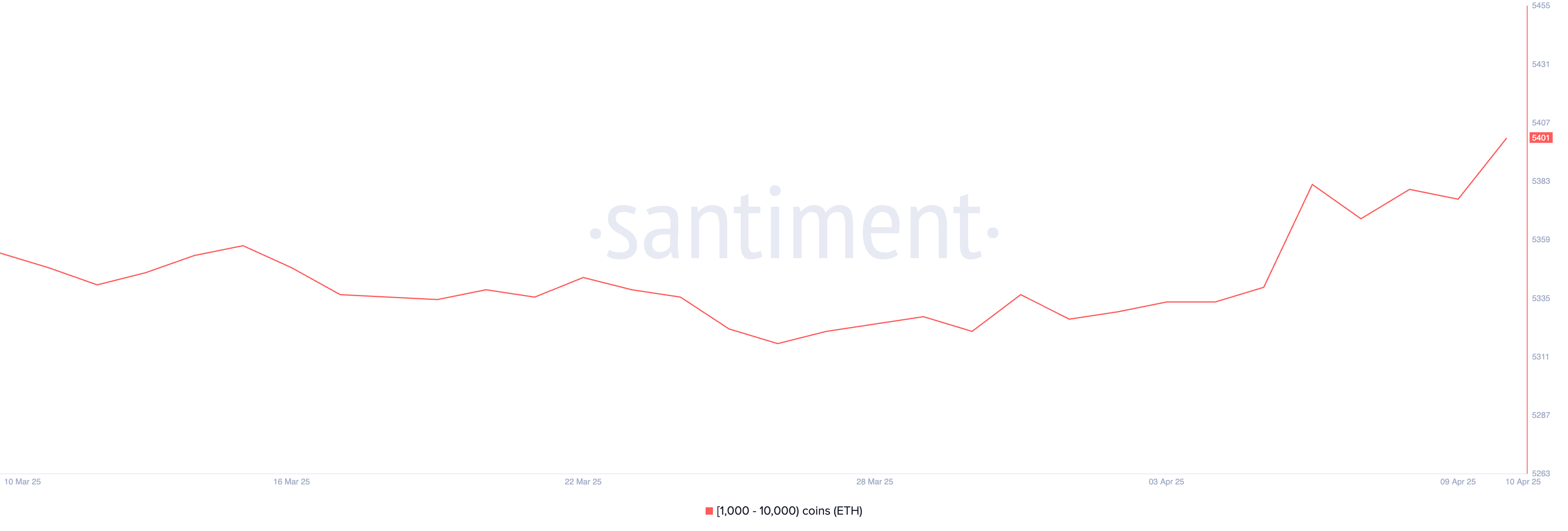

Ethereum monitored movement, with chain data showing an increase in whale crypto activity; The number of addresses, which is between 1,000 and 10,000 ETH, has reached the highest level between September 2023 from 5,376 to 5 417 between September 9 and 10 April.

If the Ethereum can maintain this renewed dynamics, it could test the level of key resistance to $ 1,749 and potentially proceed more to $ 1,954 and $ 2,104. However, macroeconomic uncertainty is still floating.

Reversing the feeling could relapse the course of the Ethereum into a support area for $ 1,412. If this level fails, a deeper decline of about $ 1,200 – $ 1,000 – possible.

Some analysts have gone so far that they compared the decline of Ethereum with the historical collapse of Nokia, warned of long -term structural weakness.

Mantra (OM)

The Kryptos of the active world’s active ingredients (RWA) has reached a new historical summit, exceeding the total value of $ 20 billion, which strengthened their growing meaning as a topic and key crypto sector.

Binance Research also pointed out that RWA tokens showed more resistance in the volatility phase than Bitcoins, which further strengthened confidence in this industry.

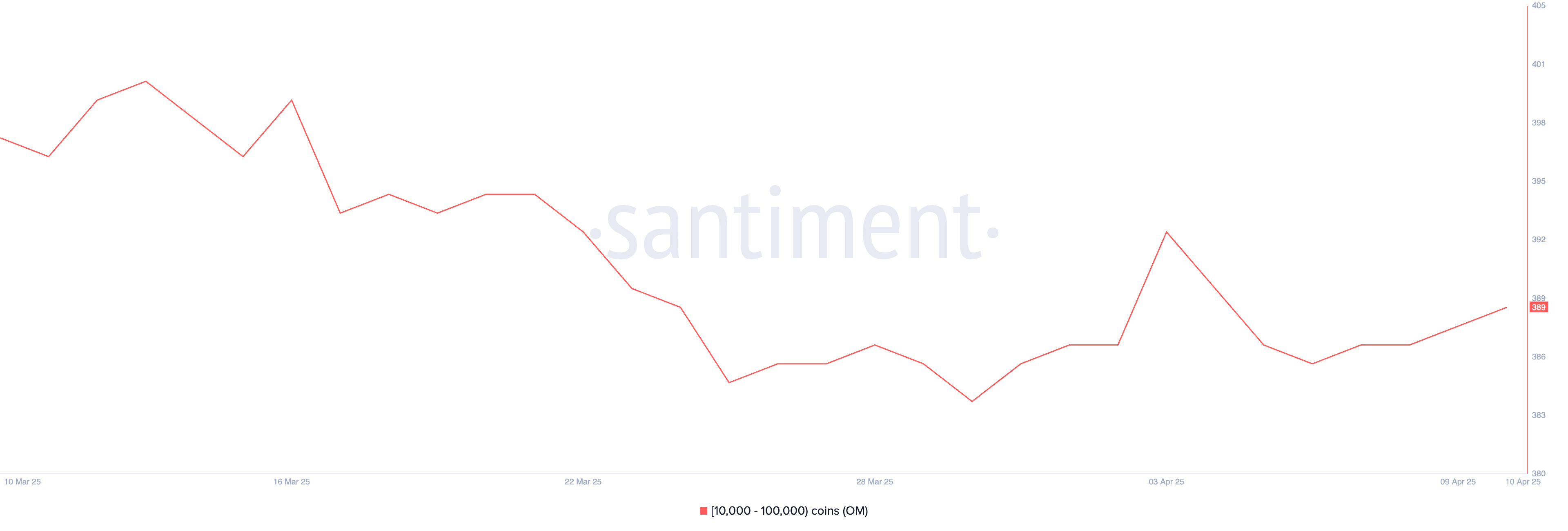

So while the topic of RWA profits in traction could benefit from a significant increase. Between 6 and 10 April, the number of OM Brashs is held between 10,000 and 100,000 chips from 386 to 389, which signals discrete accumulation.

If OM exceeds the level of resistance to $ 6.51 and $ 6.85, it could climb over $ 7. However, if the pulse disappeared, the correction could reduce the token to $ 6.11, with the risk of further decline to $ 5.68.

Onyxcoin (XCN)

Onyxcoin (XCN) has jumped by more than 50 % in the last 24 hours and exceeded the $ 0.02 brand, while the pile of the whale crypt is intensified.

Between 7 and 10 April, the number of addresses, which takes place between 1 million and 10 million XCN, increased from 503 to 532, signaling the restored interest of the main holders.

If this strong bull momentum continues, XCN could proceed to a level of resistance to $ 0.026, $ 0.033 and even $ 0.040. However, due to the rapid increase in price in the short time, correction could also be followed.

In this case, XCN could re -test support to $ 0.020, with a decrease in the potential that extends to $ 0.014 if the sales pressure accelerates.

Morality of History: Crypto whales will never miss the opportunity to accumulate.

Notification of irresponsibility

Notice of irresponsibility: In accordance with the Trust project Directives, this article for price analysis is intended only for information purposes and must not be considered financial or investment advice. Beincrypto undertakes to provide accurate and impartial information, but market conditions may change without prior notice. Always carry out your own research before making any financial decision and consult a professional.